The UK financial services industry should focus on competing with the US and Asia rather than the EU.

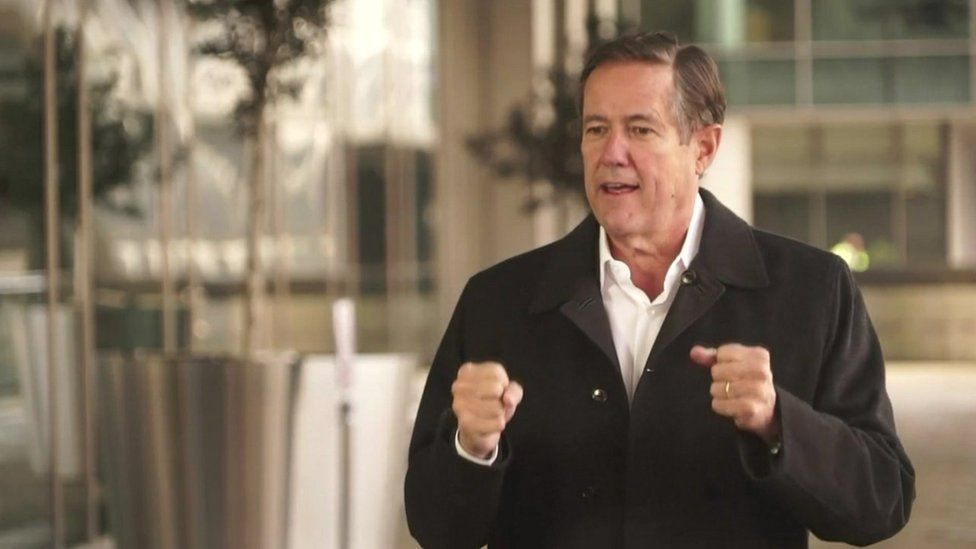

That is the perspective on the supervisor of Barclays for the City after Brexit. Jess Staley told the BBC that despite the fact that positions that would have been made here have been moved to the EU, Brexit gives one of the UK’s most significant areas the opportunity to characterize its own agenda. “I think Brexit is without a doubt on the positive side than on the negative side,” he said. “What the UK needs and London needs, is to ensure that the city is perhaps the best spot, regardless of whether it was guideline or law or language, or ability that deals with these progressions of capital well, and I’ve said, in different cases, I think what London should be centered around isn’t Frankfurt or not, Paris, should be centered around New York and Singapore”. However, he said he was not an aficionado of boundless liberation to accomplish that – no administrative huge fire for him. “I wouldn’t consume one piece of guideline.” Indeed, he said that the UK’s strong guideline was a significant strength, not shortcoming, and alluded to the new clampdown on firms offering purchase presently, pay later plans as reassuring. “You see what’s going on right now with purchase currently pay later, you know, the FCA is going to come in and begin to build the guideline of that commercial center. That is the correct thing to do. “And, in an entertaining way we’ve gotten very great at working inside the administrative system that is here. It ensures the monetary business in London as we figure out how to manage this guideline, and it makes the bank safer. “He concedes that positions that cash and occupations have moved from the UK because of Brexit yet the effect had been modest. “Yes, there are a few positions that are going to Europe that in any case would have been in the UK however it’s in the hundreds. Barclays utilizes nearly 50,000 individuals in the United Kingdom about 20,000 outside of the UK and 10,000 in the US. “So our workplaces in Frankfurt, and Paris and Milan, in Madrid, and, and without a doubt, in Dublin, are extremely strong however it isn’t so a lot. Some measure of capital has moved yet London is still clearly the primary community for Barclays.” His message is that the UK ought to do all that it can to encourage trust and great relations with the EU yet not at the expense of the UK getting uncompetitive with the greater fish in the worldwide capital pool.

Catherine McGuiness, head of Policy at the City of London Corporation, said that while monetary administrations didn’t get a lot of broadcast appointment, they are better positioned on the grounds that they began planning years back. “We have been frustrated that the absence of spotlight on the monetary expert administrations area, this is a basic piece of our economy, a basic part in itself for the positions and expense that it produces. “Yet, the moment the submission result was reported, the establishments began arranging how they would have the option to serve their clients in whatever conditions developed “One of those worldwide difficulties is clearly environmental change and Staley is persuaded London can turn into a significant worldwide center point for green account. He says these thoughts are the place where the comprehension of effect of the web was almost 30 years ago. “Climate today resembles innovation was in 1995. Looking at this logically… all the Amazons, the Google’s, didn’t actually exist in 1995 and now it overwhelms 40% of the economy, I believe it’s a reasonable contention that managing environment and managing the climate is similarly situated at this point.” Sure and dubious words for the supervisor of a bank that considers environmental change activists standard participants at its yearly investor meeting on account of its contribution in financing non-renewable energy source projects. Yet, that is the inquisitive thing about cash. You would believe it’s difficult to make new items out of it however it happens. The capacity to fund-raise in dollars on EU markets was the key new thing that impelled London to overall importance in the post-war period. Creating new items out of pools of sub-prime home loans nearly annihilated the world’s monetary system. Harnessing the global interest for financing environment based undertakings could be the following huge – and ideally great – thing. It’s harder to reexamine a fish or a sheep. Not at all like fishing and cultivating which got a great deal of political consideration, and whose organizations are truly attempting to change, UK monetary firms like Barclays appear to be sure they can adjust to a post-Brexit future. As Mr. Staley says, “you can’t burden great ideas”. The UK government figured the amazing monetary area could care for itself. On this proof, it appears they may have been right. Rishi Sunak will positively trust so. No Chancellor of the Exchequer in living memory has required the duty income more.

RSS