The International Monetary Fund has openly criticised the UK government over its plan for tax cuts, warning that the measures are likely to fuel the cost-of-living crisis.

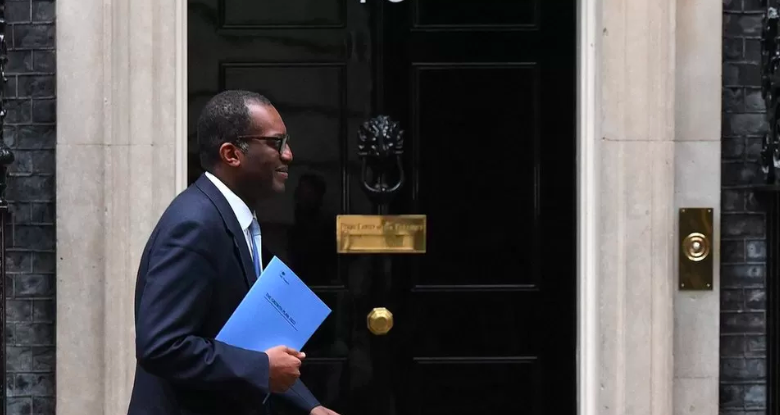

In an abnormally frank explanation, the IMF said the proposition would probably build disparity and add to pressures pushing up costs.Markets have proactively raised alert over the plans, sending the pound plunging.The public authority says the actions will launch monetary growth.On Wednesday morning UK time, the pound remained at around $1.06 in the wake of plunging by 0.7% in Asia exchange.Chancellor Kwasi Kwarteng revealed the country’s greatest expense bundle in 50 years on Friday. The £45bn cut will be supported by government getting.The IMF attempts to settle the worldwide economy, including by giving credits to nations that are battling. One of its jobs is to go about as an early monetary admonition framework.It said it comprehended the bundle planned to help development through tax reductions, yet it cautioned that the actions could accelerate the speed of cost rises, which the UK’s national bank is attempting to cut down.”Moreover, the idea of the UK estimates will probably increment imbalance,” it said.The IMF said that the public authority distributing a financial arrangement on 23 November offered it a chance to “reconsider” charge measures, “particularly those that benefit big league salary workers”.The UK government recommendations would scrap the top pace of personal duty, and end a cap on investors’ rewards, among different measures.The declaration on Friday started long periods of monetary disturbance, as financial backers unloaded the pound and UK obligation. On Monday the pound tumbled to record lows against the dollar.A portion of the country’s greatest loan specialists suspended contract bargains in the midst of the vulnerability.The Depository said: “We are centered around developing the economy to increase living expectations for everybody.”It added that Mr Kwarteng was expected to distribute his medium-term plan for the economy on 23 November, which would incorporate guaranteeing that UK obligation falls as a portion of financial result in the medium term.In the interim, Master Ice, the previous Brexit clergyman and close partner of State leader Liz Support, reprimanded the IMF’s proclamation.He told the Everyday Message: “The IMF has reliably upheld exceptionally regular financial strategies. Following this approach has delivered long periods of slow development and frail efficiency.”The main way forward for England is lower charges, spending limitation, and huge monetary change.”On Tuesday, the Bank of Britain flagged that it was ready to increase loan fees because of the downturn in the worth of the pound.Its central market analyst Huw Pill said the Bank “can’t be detached” to the improvements of the previous days.He said the Bank would need to convey a “critical financial strategy reaction” to safeguard real.Addressing BBC Two’s Newsnight, previous US Depository Secretary Larry Summers depicted the circumstance confronting the UK as “extremely unfavorable”.”I can’t truth be told recollect when a bunch of strategy declarations from a G7 country got so regrettable a reaction both from business sectors and from monetary specialists,” he said.”At the point when a nation sees its loan fees ascend by [as much as they have] in two days while its money is falling in a significant manner, that is an indication that there has been a significant loss of market validity and market certainty.”The sort of caution that England got from the IMF today is a sort of caution that comes significantly more regularly to developing business sectors with new states than to a nation like England.”Gotten some information about the UK’s arrangements at an occasion in Washington, White House monetary counsel Brian Deese said he had not been astounded by the negative response of the business sectors and that it meant a lot to zero in on “financial reasonability, financial discipline”, the Reuters news organization revealed.Moody’s FICO score office said on Wednesday that the UK’s arrangement for “huge unfunded tax reductions” was “credit negative” and would prompt higher, diligent shortages “in the midst of rising getting costs [and] a more vulnerable development viewpoint”. Moody’s didn’t change the UK’s credit rating.”We are intently observing ongoing monetary improvements in the UK and are locked in with the specialists.”We comprehend that the sizable monetary bundle declared targets assisting families and organizations with managing the energy shock and at supporting development by means of tax reductions and supply measures.”In any case, given raised expansion pressures in numerous nations, including the UK, we don’t suggest enormous and untargeted financial bundles at this point, as monetary approach must doesn’t work experiencing some miscommunication to money related arrangement.”Moreover, the idea of the UK estimates will probably increment disparity.”The November 23 spending plan will introduce an early chance for the UK government to consider ways of offering help that is more designated and reexamine the expense measures, particularly those that benefit major league salary workers.”

RSS